Compiled by Georgia Geng, Journalist Lun Zhao @GameGrapes

”TIME IS THE LEAST SIGNIFICANT FACTOR IN THE GAMING INDUSTRY” .

In the gaming industry, how long would a company prepare to win a massive triumph on the global market?

Tencent’s answer: 10-20 years

The Mission

Tencent’s overseas revenue first appeared in Tencent’s financial report was in the year of 2019, when Tencent President Pony Ma referred to gaming revenue, he brought out the idea of “half domestic, half overseas”as the goal. (Revealed by an anonymous source from Tencent ) Since then, Tencent’s SVP Xiaoyi Ma stressed during media interviews that they “wish to leverage core gameplay and high quality benchmark to achieve success instead of relying on a marketing strategy of large-scale media buy with low add-on values. It’s also a desired success across various gaming devices, in different regions and spanning across a rich variety of gaming genres, and ultimately led to the result that half the revenue coming from overseas market. “

Well, this wish/goal is easier said than done. This business strategy means that there should exist no obvious shortcomings within all the product and marketing capabilities/abilities. Looking out at the global gaming landscape, there has not been any company who can claim to have reached an ambitious goal like this.

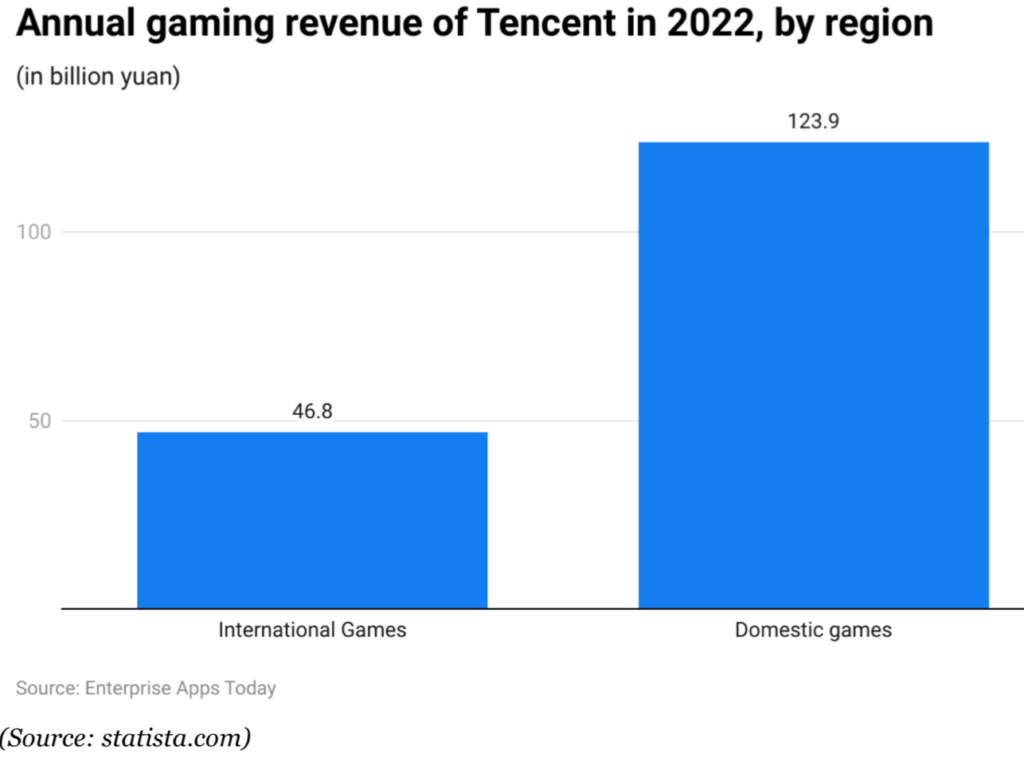

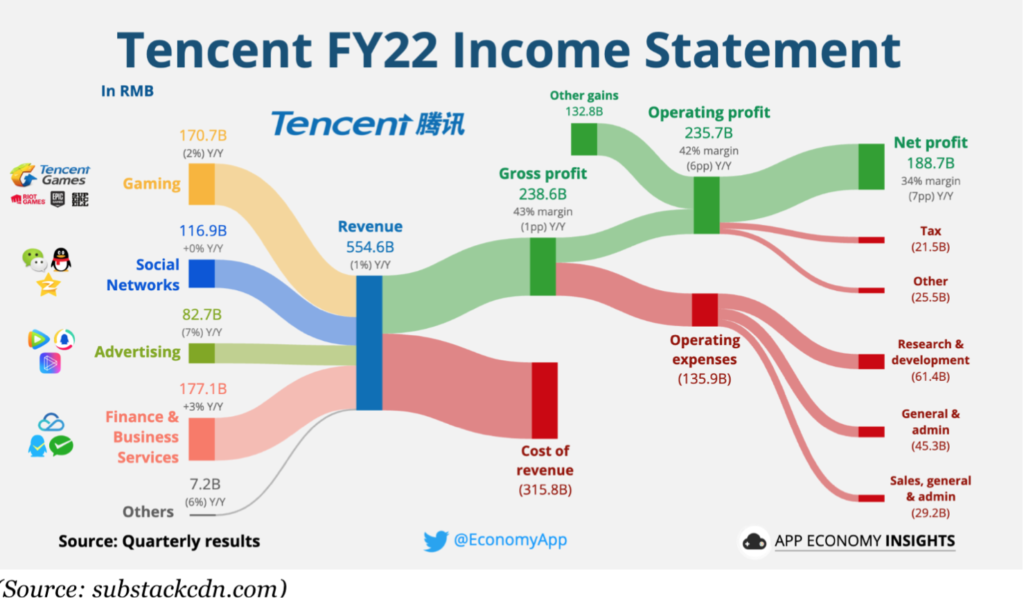

According to the financial report, in the Q4 of 2019, Tencent’s overseas revenue of games was 6.96 billion yuan($0.96billion), accounting for 23% of Tencent’s total revenue, and in the Q2 of 2023, overseas revenue was 12.7 billion($1.74billion) yuan, accounting for 28.5%.

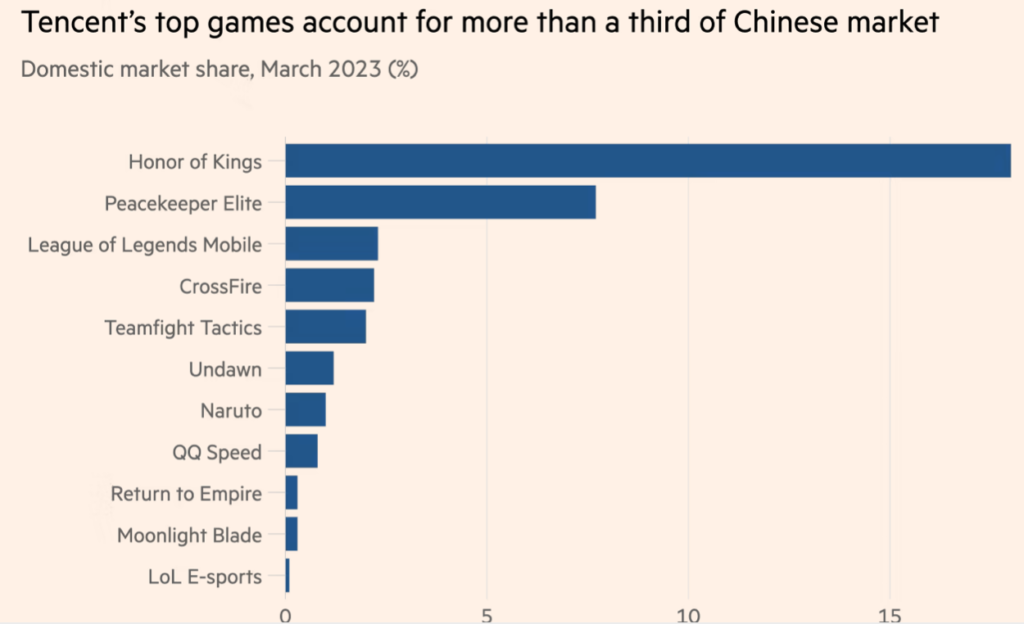

Given Tencent’s global footprint, these financial numbers appears to be a good start. However, “overseas revenue accounts for half” means that Tencent needs to recreate a revenue scale of the same magnitude as the Chinese domestic market, when Tencent already ranks the top of the gross income on gaming charts. This is apparently a very challenging goal.

The Chinese game industry always has a dream: to stand on the world stage and wrestle with blue-chip AAA game studios. As to present, Chinese game developers has made some proud achievement in certain genres and categories. But from a panoramic view, is mobile game a killer entertainment format or just a heterodoxy to drive revenue. Will “free to play” mode and “game as a service “an invincible model or will it suffer Waterloo soon?

It’s not accurate to say that Tencent started its globalization expedition in 2019, as if counts from their initial investment in Riot Games, it’s been 15 years. There are deep conceptual differences between the term“globalization” and “going overseas”.

The ultimate trick is not platform advantage but the eternal pursuit of gameplay.

Most Chinese developers hold the common sense that “Only mobile games can save the Chinese game industry”, and so far the excellent performance of those top-tier MMO Strategy, RPG, and MOBA mobile games has been supporting this assumption.

In 2023 Cologne games show, Tencent’s international game distribution brand Level Infinite announced 15 games on exhibit, out of which 70% are PC and Console games. For example, the most anticipated console game Delta Force:Hawk Ops will be launched simultaneously on PC, console and mobile platforms. Another console game SYNCED had already been launched globally during the show in August.

Timi Studio’s General Manager Yuan Yao told the journalists that mobile games was once their major focus, but there is also strong domestic demand for PC and console games. From a global perspective, it will be difficult to gain a firm foothold in Tier 1 market(US,Canada, UK, Japan) for a game title if it’s not on PC or console or has the single-player mode. After the pandemic, players in Latin America and Turkey have returned to offline life, social games’ performance in these countries are not as satisfied as expected. Therefore, Delta Force prepared a high-quality single player battle mode in addition to its tactical and multi-players war.

Why can CODM stand still? Because it’s the mobile extension of the console game, a title with cross-platform product logic. COD always have a main narrative arc on PC for each expansion version. In order to develop a hard-core game like COD, you need to have an IP that is gameplay driven and also applicable on mobile devices.

A fact hidden behind Tencent’s business strategy is that, mobile is definitely its strength, and Tencent did seize the opportunities of demographic dividend and mobile platforms’ rise. But don’t ignore Tencent’s ultimate skill: gameplay.

In 2006, Tencent’s head of gaming business Ren Yuxin had discussed the “The flank attack strategy for the latecomers” internally, suggesting to circumvent MMORPG main battlefield and laser-focusing on casual esport games. Ren wrote down the genres of gunfight, car-race, street fight, air-combat, musical dance, and said “these are the strongholds we are going to take over.”

Every 2-3 years, a new type of gameplay will emerge on the market, combined with narratives/ IP and technology, composed the driving force of the industry. But Tencent believed that gameplay should be the pillar force for market expansion, and the most essential point-cut for game innovation.

In 2008, through self-development and publishing, Tencent produced Cross Fire, Dungeons and Fighters, QQ Dance, QQ Car Race etc, which were internally named “The Four Classics”, and created the sub-genres of shooting, ACT, musical dance, racing etc. Take FPS game as an example, Tencent has never been a pioneer inventing traditional shooting game and tactical battles, but it had became one of the best FPS developers in the world, which attributes to two abilities:

- 1) Tencent has always been quietly and imminently seeking and inventing next popular gameplay. In 2007, Tencent brought “Cross Fire” to China, and began to accumulate server operation experiences. In 2013, Tencent experimented DayZ on the ArmA engine and invested in the developer Dean Hall, following by partnering with multiple FPS developing teams, such as H1Z1, and finally released the global crash-hit title PUBG Mobile with Krafton.

- 2) Valorant with Riot. After 11 years since initial partnership with League of Legend, Tencent published Valorant in domestic market, which soon became another hot FPS game.

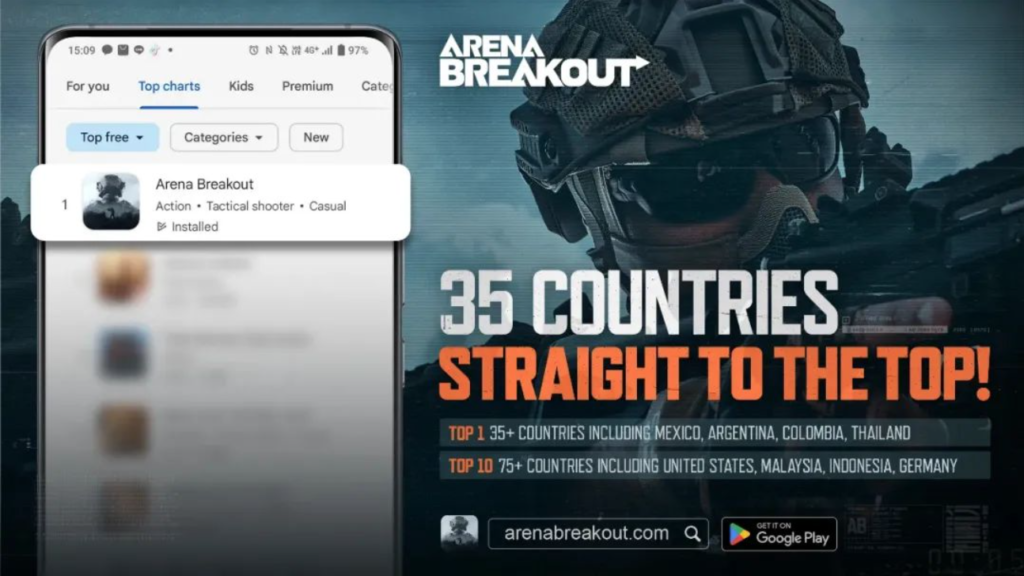

Moreover, Tencent has been always iterating and merging new gameplay. E.g. Arena Breakout solves the problem of resources mechanics and monetization problems in Escape from Tarkov, by adjusting its game structure and gameplay rotation. Now Delta Force tried to merge together tactical combat, MMO battlefield and single-player mode, while SYNCED mixed the elements of core-control, PVE, PVP and rogue-like.

Tencent VP Xiaoyi Ma once said, PC gamers make 20% of global gaming community, but provide 40% MAU; Further more, PC is the best compatible platform which enables new gameplay, new concept to be presented first on PC. In addition, major game companies usually owns dominating resources of console and mobile marketing channels, but PC still remains a market which can burst out more robust vitality.

Without doubt, using gameplay as a stepping stone to enter global market does not mean that Tencent does not attach importance to narrative content. White Night Aurora and Nikke have proven that they can manage well in publishing comic themed games, and they are thinking about every possible way to build their own IP.

For example, Lead producer of Arena Breakout once said, although it’s a gameplay driven product and thus they didn’t write much storylines, the antagonists in the game all have their own milieu background: “We have designed tons of settings of the outfits, speaking tones, and reactions to different behaviors, but we won’t tell players directly…. So that players can develop an in-depth understanding on war, human nature and interests via an immersed world. This will serve as the basis of the game IP ”.

According to Delta Force’s producer, in order to do a good job on the narrative arcs, the team has bought out the right to adapt the story of Black Hawk Down, designed the game plots, scenes and dialogues based on the original storylines of the film and carry the narrative flow in an authentic cinematic way. They also adopted the Hollywood casting process: design the character cards first, then recruiting the right live-action actors and scan their performance into the game.

In some degree, Delta Force can be also deemed as one of the microcosm of Tencent’s next gen global products:

—initiate the project from a global perspective;

—gameplay-driven with some innovation;

—Multi-platform+ GaaS

—High content quality

—R&D team leads the content creation, rather than “Chinese-Foreign teams co-production”

In other words, Tencent has gradually got rid of the identities of “an publisher owning QQ/ WeChat”, or “Cross-platform copycat”, or “mobile game industrial streamline”, and starts to leverage current capabilities to test water in more difficult and valuable spaces.

Tencent’s Investment Philosophy

Besides helping overseas teams learning about Game As A Service solution to support a long- line operation, Tencent provides more help to it’s own invested studios.

According to CEO of Ledong Game, a Tencent’s wholly-owned subsidiary: Tencent respects their decisions but helped optimize their management system throughout the entire process of Tarisland’s project ideation to research and development.

For instance, on the Cheat Engine aspect, it only takes one week for the global team to test the idea and generated conclusion, which led to a more “green” business model; On the technology side, Tencent sent 10-20 senior experts to provide onsite assistance; on the aspect of narrative design, Tencent sought advice from many AAA scriptwriters to help the game meet aesthetic taste of worldwide players.

In fact, to provide better support to developers, Eddie Chan, Chief Strategy Officer at Level Infinite said they’ve prepared four special teams to offer more specific assistance when it comes to subsidiary studio management.

Team 1: Development management, responsible for tracking the development process and milestones, setting up key timelines.

Team 2: Studio operation, responsible for studio communications, attend board meetings, draft annual budget

Team 3: Business operation, responsible for connecting studio needs, syncretize supports using a shared back-up system, and sharing tech capabilities and resources

Team 4: Partnership team, responsible for understand studio’s demands and request assistance from corporate headquarter

Eddie Chan also shared his investment strategy: they only consider teams who have a chance to achieve No.1 or No. 2 in their respective game categories.

Facing global market, Tencent has been keeping up the gameplay-driven mindset when seeking the next possible game genre on the rising path. For example, to prepare for the Survival&Construction racetrack, Level Infinite has invested in publishing a number of games such as Nightingale, V-Rising, Dune:Awakening, they are still looking at category fusion opportunities such like 60 into 1″ racing + tactical game: Wild:Racing King; Musical shooting game: Metal: Hellsinger etc.

Level Infinite is currently more prudent in terms of investing. Eddie Chan thinks the best investment mode is to partner with potential programs first and see if they can provide values for each other, then may increase the investment share after building a mutual trust. It’s like to get to know each other via dating, and talk about marriage later.

The fundamental difference between the content creative industry and the other industries is that we resonate with each other from the bottom of heart, and give your partner enough room to maneuver. We can’t just build a structural scaffold to manage everything. Respect and patience is the prerequisite of partnership. Every studio has its own vision, Tencent won’t stifle them but only offer encouragement and sources to help.

Taking Stunlock as an example, in 2016, Tencent got in touch with this Swedish team of dozens of members, co-released a combat+MOBA game Battlerite Royale, but only received a tepid market response. Years later in 2019, Tencent invested in them and 6 years later, the new game V Rising gained massive popularity.

Tencent’s partner studios do not have to hand over their game to Tencent for publishing, there could be deep collaboration between these subsidiary studios. For example, Pathfinder’s publisher is Digital Extreme, who developed and published Warframe.

Today’s Tencent shows a new collaboration attitude, he is like a big bro hoping to do business with you but also fully respect your wishes. As long as you are willing to work with him, he will treat you as a friend, and share his resources, expertise, contacts and life lessons.

This business attitude is seemingly gaining recognition from partners. As Xiaoyi Ma said, five years ago, Tencent’s overseas investment is simply funding, but now we offer plenty of supports from project ideation, development all the way to game launch. They are getting better and better integrated into the global game development ecosystem.

Tencent’s Long Expedition

Frankly speaking, Tencent has not yet developed and published a global phenomenal game, like a house-name game title. PUBG is a mega-hit , but was developed by a Korean company Krafton and Tencent mainly helped published the game in Asia.

However, we also saw Tencent’s interpretation and tenacity for globalization, they are all out to prepare for everything, and also strive to make steady progress and open-minded enough as a large enterprise. This working style seems different from most major companies in the industry.

On the localization aspect, Level Infinite has offices in North America, West Europe, East Europe, SouthEast Asia, Latin America, Middle East and Africa. But their partner studios across the globe still possess high autonomy right.

Tencent’s Breakout Arena leverage a combined resource of overseas office as well as the product and publishing experience of the domestic team, they developed a customized publishing strategy without using large scale media buy but instead picked their own community influencers and grow the online content, thus successfully formed their initial players ecology.

If we roughly divide the global market into three market categories:

1. Mature market: Europe, America, Japan and Korea

2. China

3. Emerging Market: Latin America, SouthEast Asia, middle-east

The respective market share for the 3 parts may be 4:2:1, and will developed to 4:3:2 in the future, among which Tencent wish to remain a leading position in China, and meanwhile takes up a reasonable share in the first and third categories. This may also be the source idea of “Half domestic, half overseas” in terms of revenue split. However, considering the current growth speed of the gaming industry, this ambition is impossible to realize in five years.

Even without gameplay-driven innovation and investment partnership, Tencent has been planning for overseas market since long time ago. In 2016, Arena of Valor has already been put into production agenda.

A little known fact is that as early as 2013, Tencent already had a “Westward Plan”, which is dedicated to recruit elite college graduates from global education institutions. The company also tried to hire working professionals who are interested in working on overseas market, preparing talents for global partnership. A Tencent employee who participated in “Westward Plan” recalled that they were required to going through an eight months of full time training, play the best games in each category and draft review reports and present work result to a jury of General managers and experts on a bi-weekly basis. At that time, our goal was to recruit 15 elite graduates from overseas, but we were stopped at the 14th candidate and not able to hire anymore, finally a student from a domestic university did 10 interviews with us and got the last seat as an exception.

Overs so many years, one worker after another, one product after another, jointly created this unprecedented expedition across teams, companies, platforms and regions in the gaming industry. This crucible expedition will define Tencent’s future in 20-30 years as well as set the growth ceiling for him.

Our journalist has asked many team leaders at Tencent about how they see the future of the company’s overseas business. The answers can be various but also as plain as the nose on the face.

Guyu believes that It may take longer time to realize our vision. “Many of our masterpiece were not ready yet, we still need to rely on existing products to generate enough profits for us to grow new strength.” In his opinion, as long as the AAA+GaaS mode can work out, it can prove Tencent’s publishing ability with original IP and PC games, then success may not be that far.

“The top companies both from China and overseas are walking from two ends of a bamboo pole to the middle”. Mr Yao said, “when other overseas companies are learning GaaS and F2P practices, Tencent is also cramming for industrialization and content skills. It’s just that Chinese companies are more eager to learn and so far have gone a bit faster on the progress. “We recently hired an animator with 20 years of experience from a AAA team , he said we are working damn hard and too eager to learn!

Antony said”we would never worried about the current brand awareness of Level Infinite as I am confident with Tencent’s current team and product line. Players won’t care what you’ve done in the past, they only care about the next big thing, and players will love our brand because of a beloved product. And we have found a long-term path to remain competitive in the industry, which is “Content is the King”.

It is said in internal meetings, Tencent’s senior management team sees their movement in overseas market just as a “body warm-up”. Even though Level Infinite has been founded for two years, the real battle hasn’t started yet. Tencent is still building up the fortress and storing supplies.

Some people might think Tencent is marching slowly on this expedition, Xiaoyi Ma also feels that they need to speed up a bit, but all the experience and lessons told us that “Time is the least significant factor in the gaming industry”.

References:

https://www.enterpriseappstoday.com/stats/tencent-statistics.html; https://www.ft.com/content/6921a1cc-9874-4258-8fe8-3d01f5648a1e; https://mp.weixin.qq.com/s/VARq_lZJEhK8R2wgYSl2LA