By Sense Tower

This report will analyze the download and revenue trends of mobile games in Southeast Asia in recent years, the changes in downloads and revenue of mobile games in different countries and categories, as well as the top download and revenue charts, and introduce how Honor of Kings achieved success in the overseas markets through case analysis.

In the first half of 2024, the mobile game downloads in the Southeast Asian market grew by 3.4% period-on-period to 4.2 billion, with Indonesia being the country with the highest mobile game downloads in the region, contributing 41% of the total downloads. Meanwhile, the mobile game downloads in Indonesia grew by over 15% period-on-period in the first half of 2024, becoming the growth highlight of the Southeast Asian mobile game market.

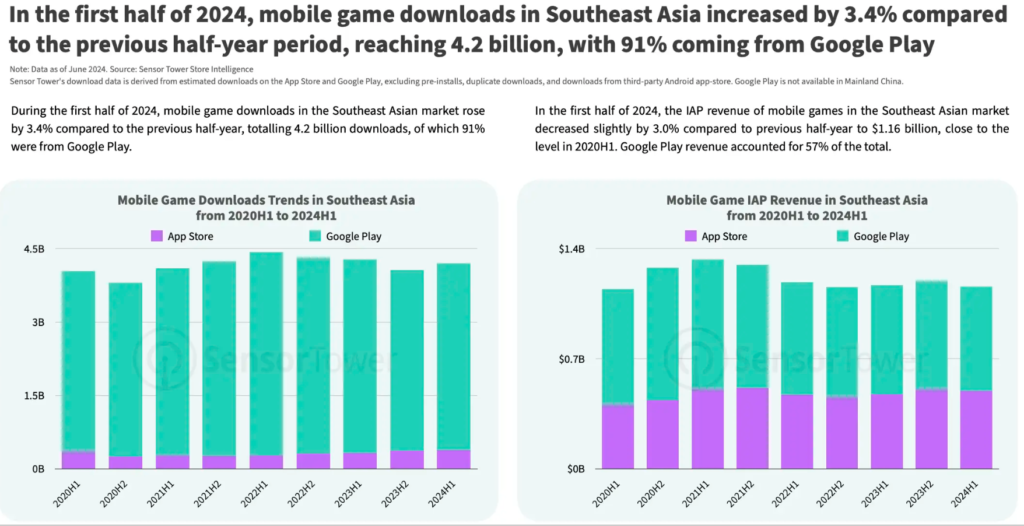

In the first half of 2024, the mobile game downloads in the Southeast Asian market rebounded to 4.2 billion

In the first half of 2024, the mobile game downloads in the Southeast Asian market rebounded to grew by 3.4% period-over-period to 4.2 billion, with 91% coming from Google Play.

The mobile game IAP revenue in the Southeast Asian market declined slightly by 3.0% period-over-period to $1.16 billion, close to the 2020H1 level, with 57% coming from Google Play.

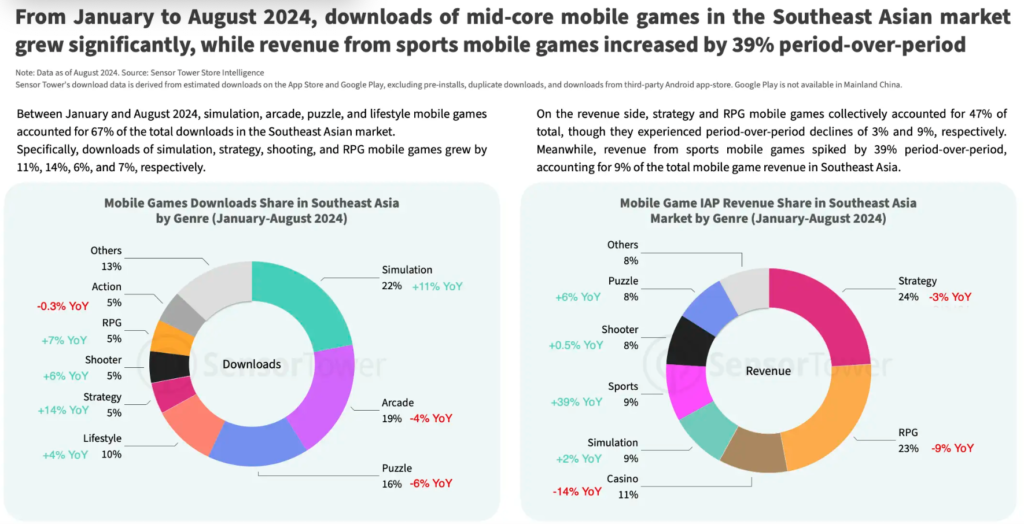

Simulation games recorded an 11% period-over-period increase in downloads, while sports games experienced a 39% surge in revenue

In the Southeast Asian region, simulation is the mobile game genre with the highest downloads. In 2024, multiple simulation games such as Supercent’s pizza shop simulation game “Pizza Ready!” and CodeXplore’s food delivery driver simulation game “Ojol The Game” demonstrated remarkable download growth performance in the Southeast Asian market, leading to an 11% period-over-period increase in total downloads of simulation games to 1.2 billion in the period of January to August 2024.

In the period of January to August 2024, strategy and RPG continued to be the highest revenue-generating mobile game genres in the Southeast Asian market, contributing 24% and 23% of the total revenue respectively. The sports mobile game segment demonstrated an outstanding performance, with the top titles eFootball™ 2024 and EA SPORTS FC™ Mobile Soccer achieving nearly 80% and 20% period-over-period revenue growth in Southeast Asia respectively, driving a 39% period-over-period surge in the overall sports game revenue in the region.

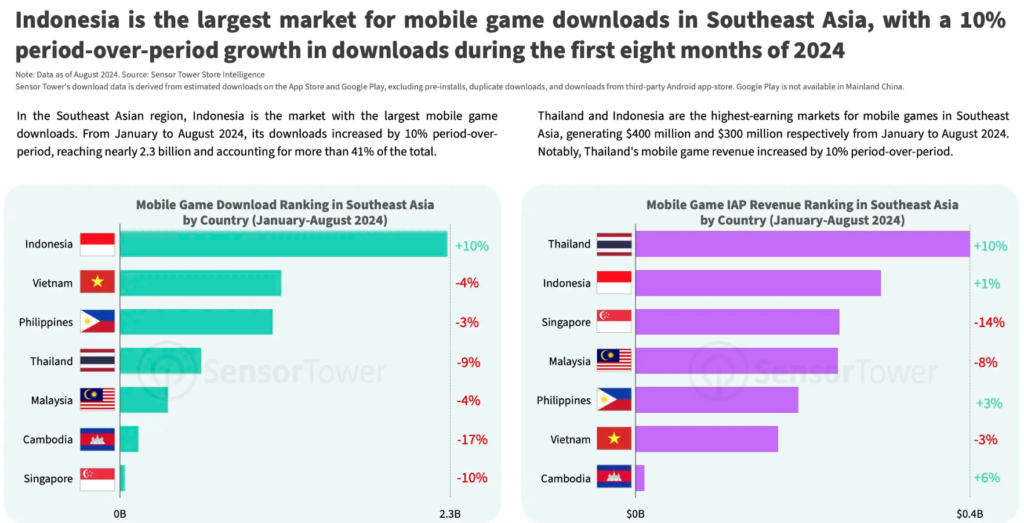

Indonesia is the largest mobile game market by downloads in Southeast Asia

More than 41% of the total mobile game downloads in Southeast Asia were contributed by the Indonesian market. From January to August 2024, the mobile game downloads in Indonesia grew by 10% period-over-period, becoming the Southeast Asian market with the highest growth in this metric.

Regarding mobile game revenue, Thailand is the largest market in Southeast Asia. From January to August 2024, the mobile game revenue in this market increased by 10% period-over-period to over $400 million.

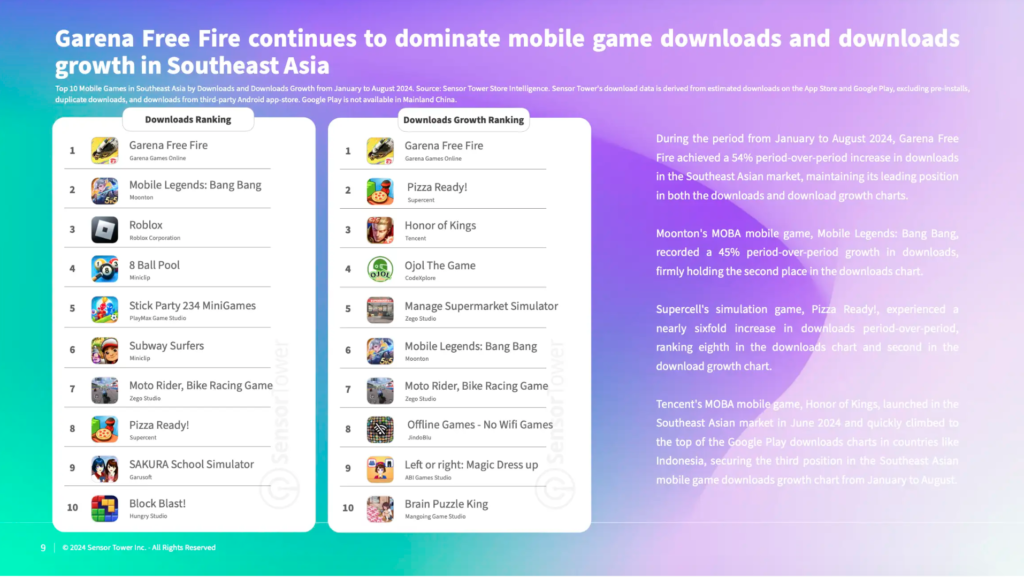

Garena Free Fire Remained No.1 in the Southeast Asian Mobile Game Download Chart

From January to August 2024, thanks to the launch of a series of events such as “The Chaos”, “2024 Ramadan Campaign”, and “Mechadrake”, Garena Free Fire’s downloads in the Indonesian market surged by 110% period-over-period, and by 54% period-over-periodin the overall Southeast Asian market, maintaining its position as the mobile game with the highest downloads and the fastest download growth in the region. The game also remained the champion of the global mobile game download chart.

Moonton’s MOBA mobile game Mobile Legends: Bang Bang recorded a 45% period-over-period increase in downloads, firmly holding the second place on the download chart. Indonesia is the market with the highest downloads for this game, contributing 44% of its global total downloads from January to August 2024, while its rich in-game events also led to a 72% period-over-period increase in downloads in Indonesia.

Supercell’s simulation game Pizza Ready! recorded a nearly 6-fold increase in downloads period-over-period, ranking 8th on the download chart and second on the download growth chart. In the global market, Pizza Ready! claimed the top position on the download growth chart.

Tencent’s MOBA game Honor of Kings launched in the Southeast Asian market in June 2024 and quickly reached the top of the Google Play download charts in markets like Indonesia, securing the 3rd place on the Southeast Asian mobile game download growth chart from January to August.

Mobile Legends: Bang Bang Remained the Revenue Champion in Southeast Asia

Moonton’s MOBA mobile game Mobile Legends: Bang Bang saw a 6% period-over-period increase in revenue in the Southeast Asian market, retaining the revenue champion position. Konami’s sports mobile game eFootball™ 2024 topped the revenue growth chart, with a surge of nearly 90% in revenue period-over-period in Southeast Asia in the period of January to August 2024, securing the second position on the revenue chart.

In early March 2024, Joy Net Games’ RPG game Legend of Mushroom launched in the Southeast Asian market and quickly rose to the top of the App Store and Google Play download charts in markets like Thailand and Vietnam. As of August 2024, the game had generated over $11 million in revenue in the Southeast Asian market, ranking 3rd on the growth chart, with Thailand and Vietnam each contributing over 25% of the revenue.